Interested in being a living donor?

If you are considering being a living organ donor, it’s important to educate yourself about the donation process, required testing, financial considerations, risks, and recovery. For more information on living donation, please visit Transplant Living.

What is living donation?

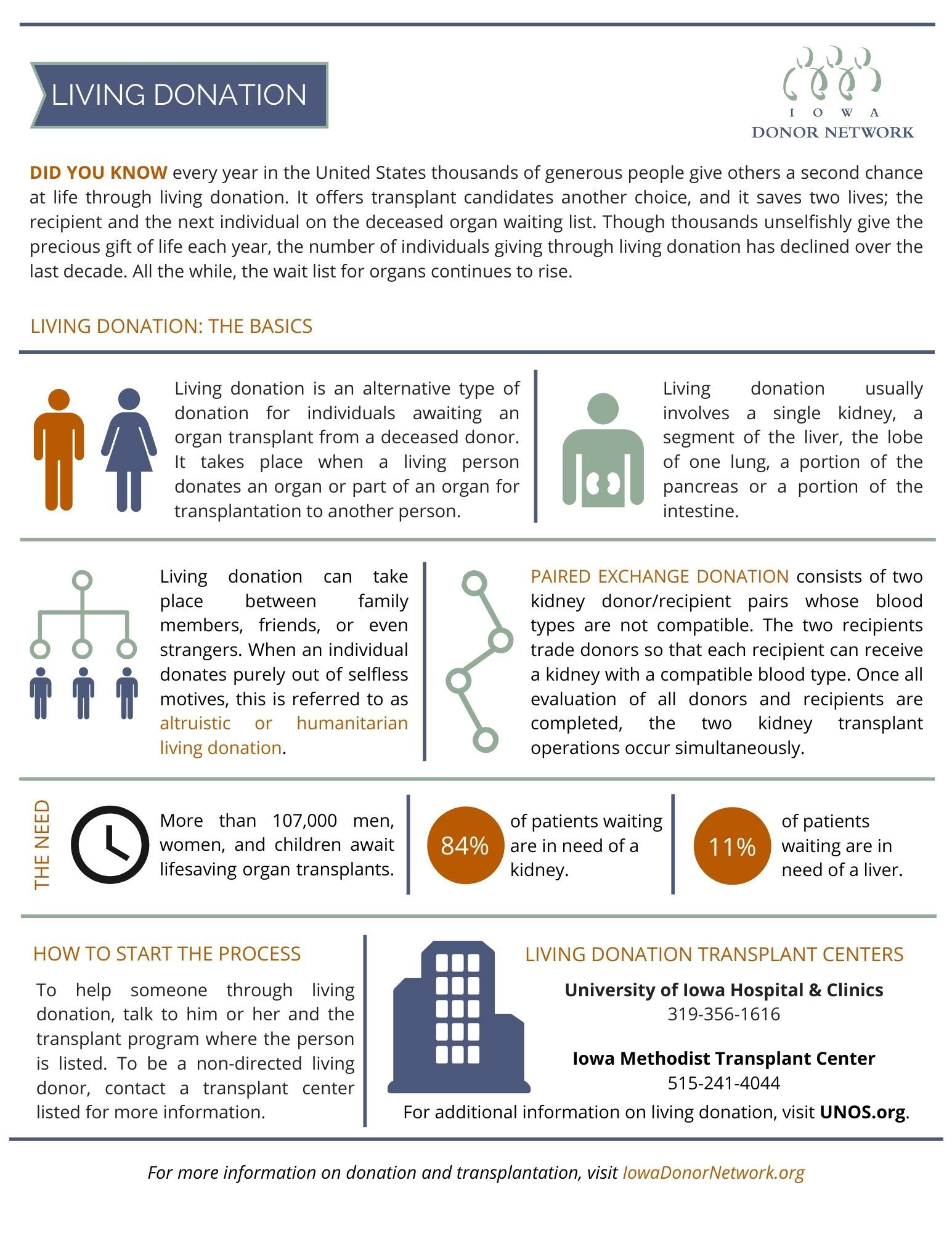

Living donation is an alternative type of donation for individuals awaiting an organ transplant from a deceased donor. Living donation takes place when a living person donates an organ or part of an organ for transplantation to another person.

Living donation usually involves a single kidney, a segment of the liver, the lobe of one lung, a portion of the pancreas or a portion of the intestine.

There are several types of living donation:

Related living donation

Related living donation involves the donation of an organ or a part of an organ from one blood-related family member to another. Donors may be siblings, parents, or other blood relatives such as aunts, uncles, cousins, etc.

Non-related living donation

Non-related living donation involves the donation of an organ or part of an organ from an emotionally close but non-blood related person to another. Donors may be spouses, in-law relatives, close friends, co-workers, neighbors, or other acquaintances to the recipient.

Non-directed donation

Non-directed donation involves living donors who are not related to or known by the recipient, but make their donation purely out of selfless motives. This is also referred to as anonymous, altruistic, and stranger-to-stranger living donation.

Paired exchange donation

Paired exchange donation consists of two kidney donor/recipient pairs whose blood types are not compatible. The two recipients trade donors so that each recipient can receive a kidney with a compatible blood type. Once the evaluations of all donors and recipients are completed, the two kidney transplant operations are scheduled to occur simultaneously.

Legislation

Federal Legislation

Federal employees receive 30 days paid leave for organ donation, in addition to their sick and annual leave (HR 457).

State Tax Deductions/Credits

HF 801, authored by Rep. James Van Fossen on 5/12/05, allows living organ donors to deduct as much as $10,000 on their state income taxes for travel, lodging and lost wages related to the donation.

Donor Leave Laws

HB 381, enacted 8/28/03, provides up to 30 workdays of leave for vascular organ donation by state employees.

If you are interested in being a living donor and know someone whom you would like to donate to, you should contact their transplant center. If you are interested in non-directed donation, you can contact one of the three transplant centers in Iowa. For contact information, please click here. Please also share with us your decision to be a living donor. We would love to hear from you!

Anatomical Gift Transplantation Fund

If you are a living donor you may be eligible to receive grant funding via the Anatomical Gift Transplantation Fund (AGTF). In 1996 the Iowa Legislature established an Anatomical Gift Transplantation Fund (AGTF) (see Iowa Code 142C.15). At the time of motor vehicle registration or renewal, Iowans are asked if they wish to donate a dollar or more to this fund. These donated funds may be used to award grants to transplant recipients or candidates, living organ donors or legal representatives. The purpose of the grant is to provide financial assistance for the reimbursement of out-of-pocket costs incurred by the patient (applicant) and not available from any other third-party payer.